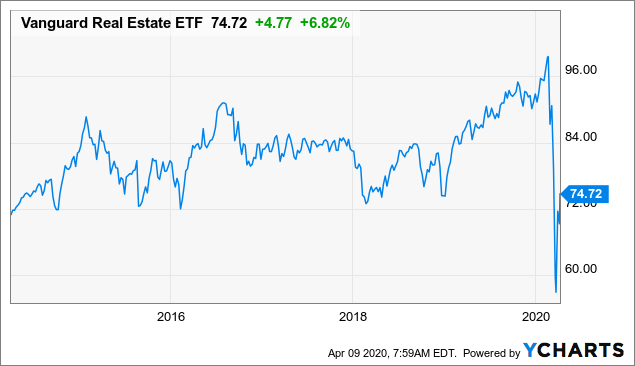

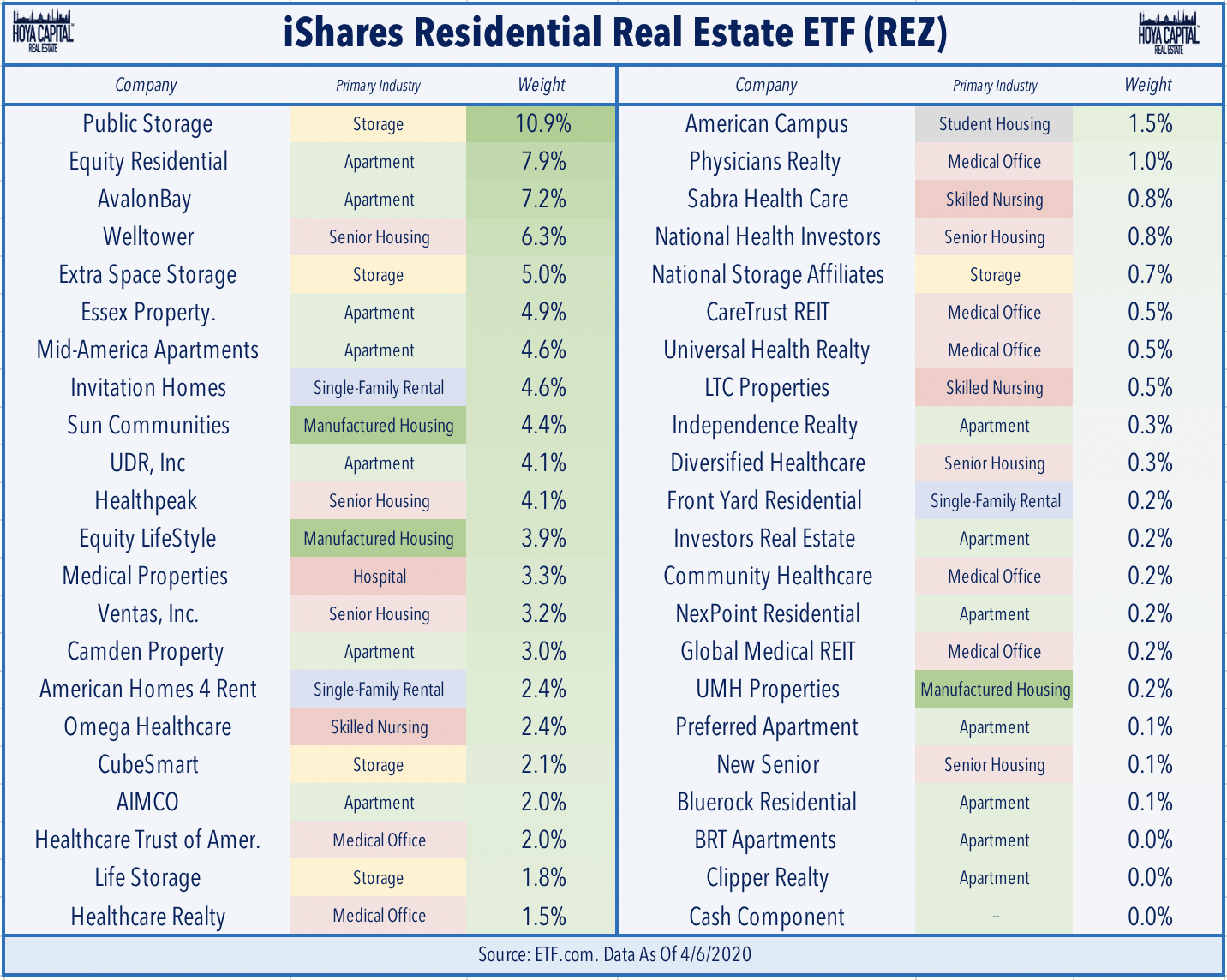

If you want to invest in real estate but can t afford to invest in properties directly or build a diverse portfolio of reits a reit etf may be the right starting point for you.

Senior living reit etf.

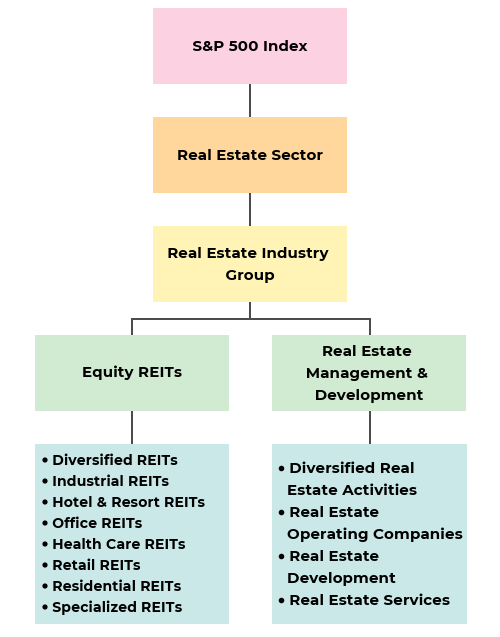

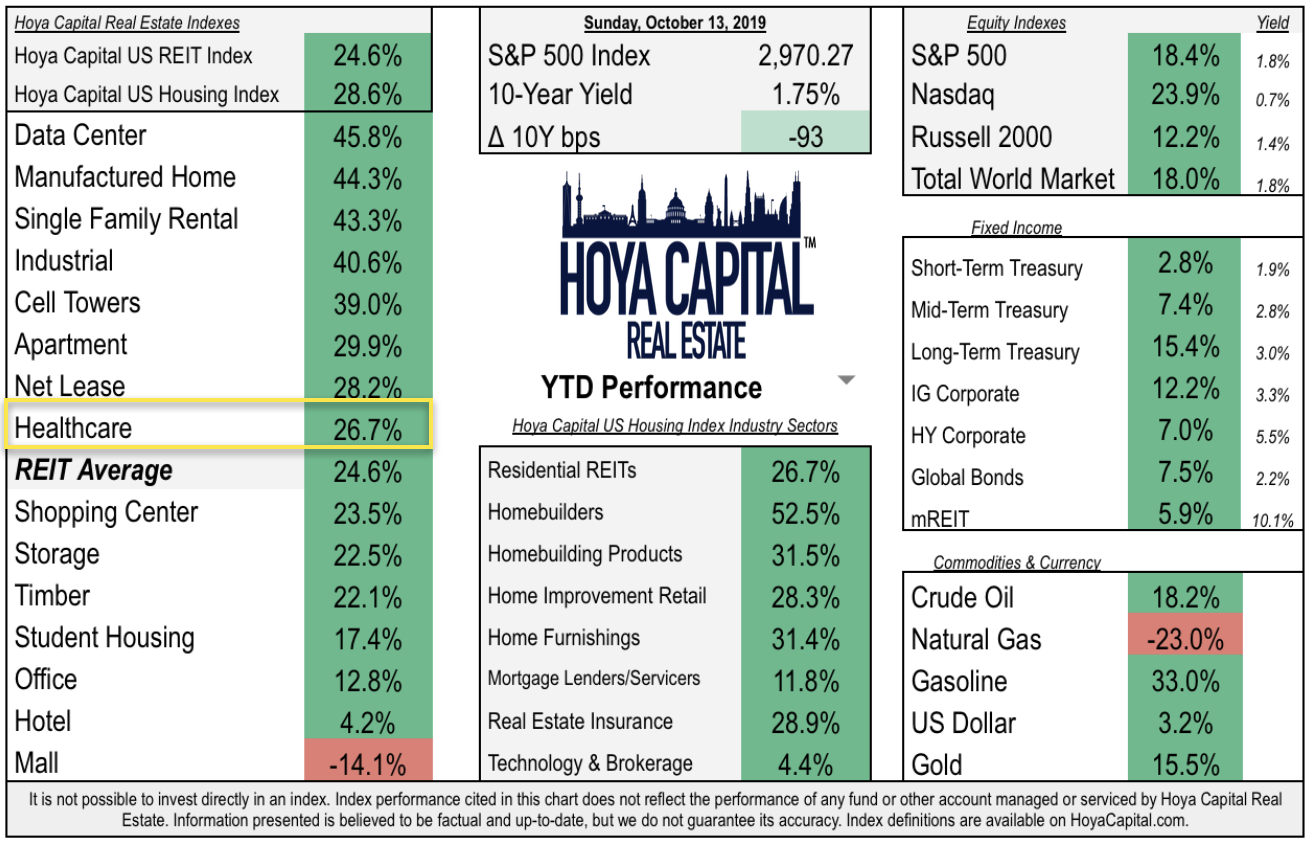

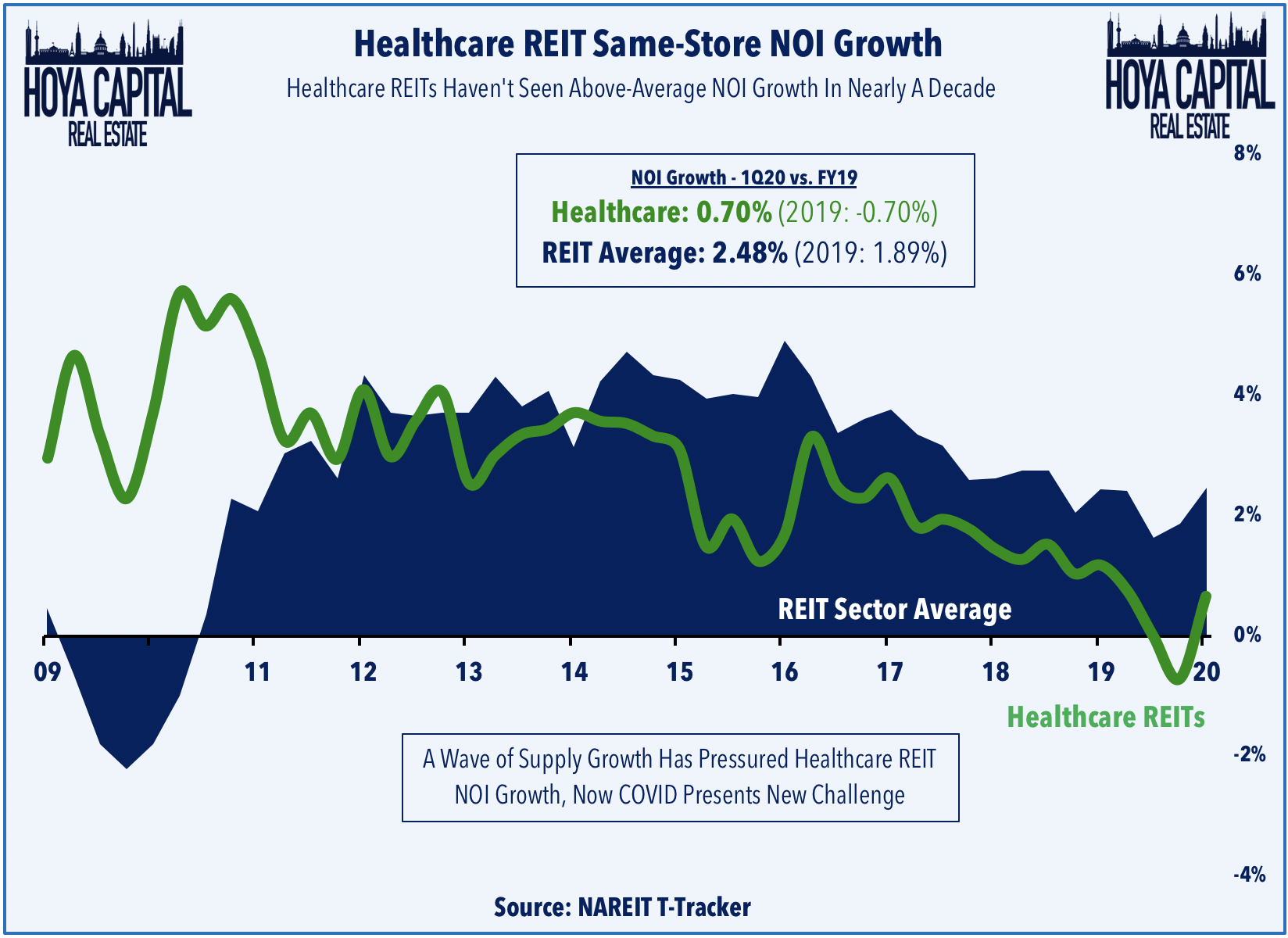

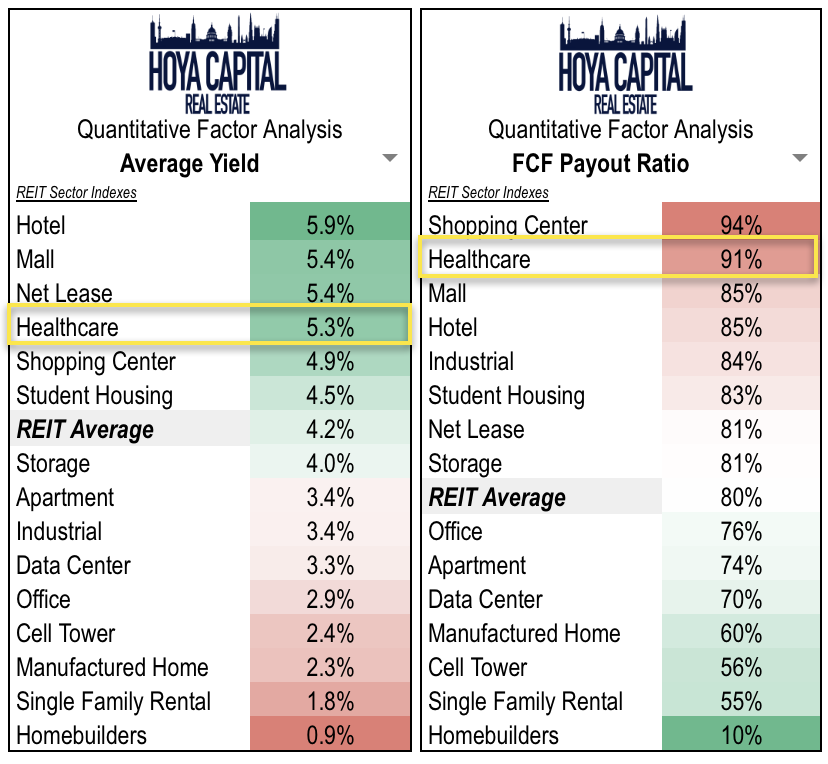

Senior living reits are largely in the healthcare reit sector.

Senior housing property trust s credit ratings of bbb baa3 while still investment grade are lower than those of the other reits discussed.

Like all reits these firms are not subject to federal income tax so long as they distribute 90 of their taxable income to shareholders.

A reit etf is a type of fund made up exclusively of reit stocks.

The portfolio is 71 skilled nursing facilities 19 assisted independent living senior housing and only 10 non senior focused properties.

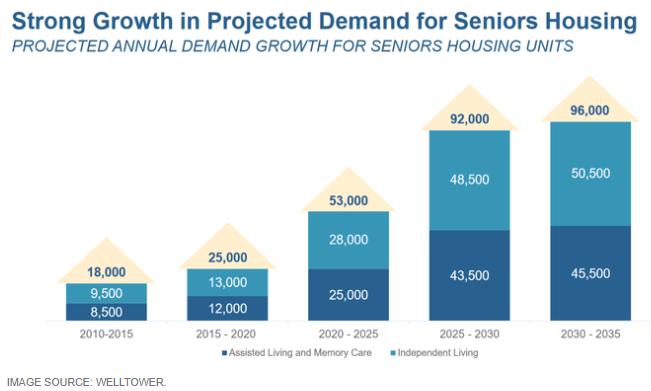

A health care real estate investment trust known as reit could be a smart move if you want to capitalize on aging trends by including senior housing medical and nursing facilities in their.

It has a low expense ratio of 0 12 so investors don t have to worry about the expense chipping away at.

In other words senior housing property trust has a.

Senior housing properties trust snh one of the biggest players in the senior housing segment with 372 properties spread across 38.

Senior housing trust snh next on the list of reits to buy.

This vanguard reit etf is a great income producing investment with a yield of 4 1.

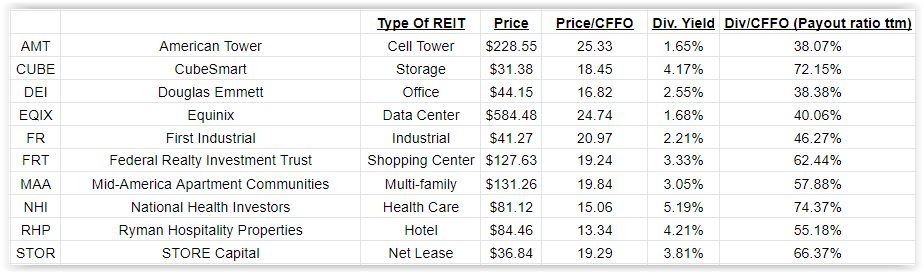

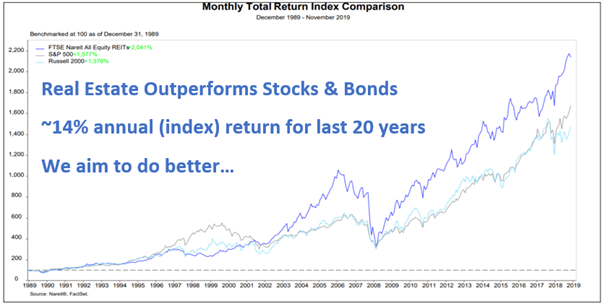

The 10 best reits to buy for 2020 real estate offers diversification and far more income than the market average.

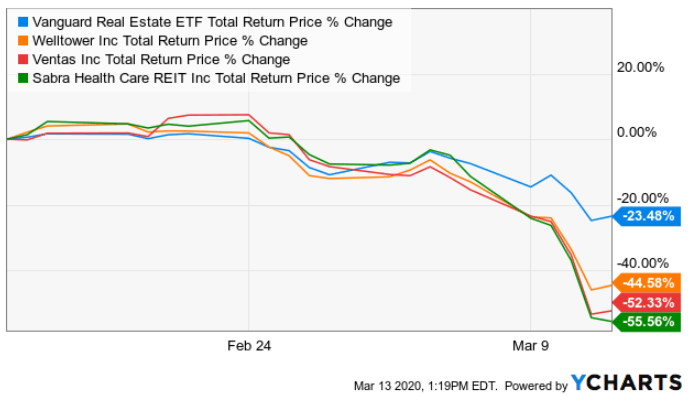

Risks of investing in senior living reits.

Beyond the questions above you should.

The percentage of healthcare and specifically senior living reits will vary from reit to reit.

These are the 10 best reits you can buy as 2020 comes into focus.

/GettyImages-963050722-19a496349461484684d839542ae28429.jpg)

:max_bytes(150000):strip_icc()/GettyImages-820225090-94d2224ff143430ba34c49e414585530.jpg)